Since Singapore is frequently cited by many as a leading example of nations that continuously reduces income tax rates of corporations, it pays if firms learn how to do corporate tax planning Singapore. This becomes essential since the country introduces many tax incentives toward attracting and keeping global and local investments.

Note that Singapore holds a single-tier local-based flat-rate income tax scheme for corporations. As a result, its effective tax percentage of 17% on corporate income is among the smallest globally. On top of that, its general ease of business is another crucial factor that contributes to its local and foreign investment, and economic growth.

Moreover, recognizing the importance of continuously drawing in foreign investment, Singapore has made a significant effort to collaborate on bilateral taxation pacts with approximately 100 jurisdictions. As a result, this eliminates the plight of companies being taxed twice on the same income.

Corporate Tax Planning Singapore: Tax Planning Objectives & Advantages

Every person doing business knows that taxes may eat up a big slice of a firm’s annual earnings. Thus, tax planning is a legitimate means of reducing corporate tax liabilities for each financial year. Moreover, it offsets the impact of taxation by utilizing tax deductions, exemptions, credits, and benefits set forth by law in the best possible way to minimize tax due. So, how to do Singapore corporate tax planning remains simply analyzing the financial situation of a business in Singapore from the tax efficiency viewpoint.

Financial planning revolves around tax savings while simultaneously obeying the official obligations and requisites of the Income Tax Act 1947. Therefore, the primary tax planning concept is saving money and mitigating the tax burden of firms. Still, there are other objectives in knowing how to do Singapore corporate tax planning, such as:

Ensure economic strength

The money of taxpayers is given to the progress of the city-state. Therefore, effective corporate tax planning and management can provide a wholesome inflow of money that brings about good economic growth, benefitting the citizens.

Leverage productivity

The central tax planning goal is channeling funds from chargeable sources to various income-generating plans. As a result, this ensures the best utilization of funds aimed at productive causes.

Minimize litigation

To sue is to settle tax clashes with local or foreign tax groups. Often, there is friction between taxpayers and collecting agencies as the latter attempts to secure the most immense amount possible, whereas the former wants a small tax liability. Hence, learning to do Singapore corporate tax planning can reduce litigation that involves the firm’s legal obligations.

Reduce tax charges

Naturally, aside from the goal of saving funds for future use, every taxpayer wants to lessen their tax burden. The reduction of the tax payable is facilitated by arranging investments around the many benefits offered by the Income Tax Act 1947.

Corporate Tax Planning Singapore: Singaporean Tax Credits

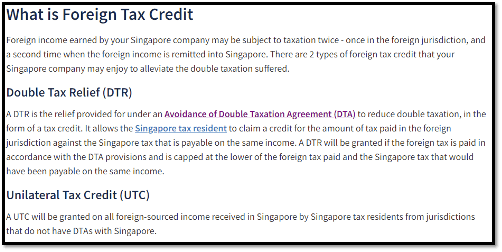

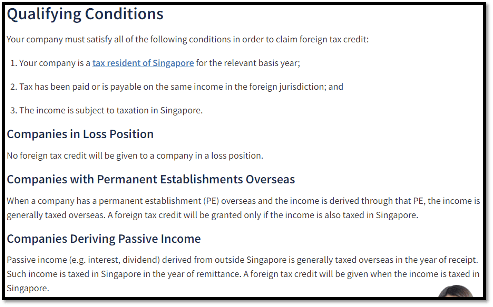

UTC and FTC contents should be summarized from the below contents extracted from Singapore tax authority (IRAS) website:

Corporate Tax Planning Singapore: Tax Incentives in Singapore

Other than the above-cited tax credits, there are many other incentives that Singapore firms can consider when doing corporate tax planning. Some examples are:

International or Regional Headquarters Award

This tax incentive grants a five to ten percent corporate tax percentage on the gradual income from eligible activities under the schemes.

Land Intensification Allowance or LIA

Companies that meet the requirements for LIA may claim to qualify for investment expenditure on the building of an eligible structure.

Mergers and Acquisitions or M&A Scheme

This scheme gives an allowance to firms buying other firms’ ordinary stocks. This allowance is permitted for five years on an equal basis without any postponement. Note that the purchase must be from April 1, 2010, until December 31, 2025.

Partial Tax Exemption

This entitles eligible firms tax exemptions on their initial chargeable income of SGD 300,000, as follows:

- 75% tax exemption on the initial chargeable income of SGD 10,000; and,

- 50% tax exemption on the following chargeable income of SGD 190,000.

Pioneer Certificate or PC Incentive

This incentive is available to companies demonstrating their expertise as significantly more progressive than what is already on hand in the city-state. The tax incentive for qualified firms is a five percent tax rate for five years.

Start-up Tax Exemption

The eligible Singapore tax resident companies have 75% exemption on their first SGD 100,000 of normal chargeable income. Additionally, they enjoy a further 50% exemption on the next SGD 100,000 of normal chargeable income.

On top of the incentives listed above, there are still other tax incentives, such as the Land Productivity Grant, Development and Expansion Incentive (DEI), Finance and Treasury Center Tax Incentive, Aircraft Leasing Scheme, Research Incentive Scheme, Initiatives in New Technology, and other industry-related tax incentives.

At Premia TNC, we understand that learning how to do Singapore corporate tax planning is not everyone’s cup of tea. For that reason, we are here to extend help to Singapore companies. Our team of corporate tax experts can facilitate all of your company’s tax needs. So don’t hesitate to contact us for a consultation at no cost at the soonest possible time.